Master Qualité -

Communication publique des résultats d'un stage de fin d'études

UTC - rue Roger Couttolenc - CS 60319 - 60203 Compiègne Cedex - France - master-qualite@utc.fr - Tél : +33 (0)3 44 23 44 23

|

|

Avertissement : Si vous arrivez directement sur

cette page, sachez que ce travail est un rapport

d'étudiants et doit être pris comme tel. Il peut donc

comporter des imperfections ou des imprécisions que le

lecteur doit admettre et donc supporter. Il a été

réalisé pendant la période de formation et constitue

avant-tout un travail de compilation bibliographique,

d'initiation et d'analyse sur des thématiques associées

aux concepts, méthodes, outils et expériences sur les

démarches qualité dans les organisations. Nous ne

faisons aucun usage commercial et la duplication est

libre. Si, malgré nos

précautions, vous avez des raisons de contester ce

droit d'usage, merci de nous en faire part, nous nous

efforcerons d'y apporter une réponse rapide. L'objectif de la présentation sur le Web est de

permettre l'accès à l'information et d'augmenter ainsi

les échanges professionnels. En cas d'usage du document, n'oubliez pas de le citer comme source bibliographique.

Bonne lecture... |

Implementation of

Electronic Data Interchange Technologies by Suppliers

as solutions to enhance Traceability in upstream Supply

Chain

|

Kartika NURHAYATI

|

Référence bibliographique à rappeler pour tout usage :

Implementation

of Electronic Data Interchange Technologies by Suppliers

as solutions to enhance Traceability in upstream Supply

Chain, NURHAYATI Kartika, Université de

Technologie de Compiègne, Master Qualité et

Performance dans les Organisations (QPO), Mémoire d'Intelligence

Méthodologique du stage professionnel de fin

d'études, www.utc.fr/master-qualite, puis

"Travaux", "Qualité-Management", réf n°295, juin 2014

|

ABSTRACT

Background - Visibility and traceability are

vital to build an effective upstream supply chain

management. As the volume of companies’ purchases

increase, process automation has been seen as a mean to

provide accurate traceable information and a more

efficient coordination, thus contributes to various long

term competitive advantages.

Purpose – In this paper, the traceability issue will be

addressed by focusing on the different flows of

information that can be automated. This paper also

demonstrates the implementation of new business systems

among supply chain department and suppliers of Enterprise

E to improve traceability.

Methodology - Using a combination of three technological

change approaches, EDI (electronic data interchange) was

introduced to suppliers of Enterprise E: 1) Supplier Web

Portal to facilitate purchasing process traceability, and

2) barcode labels to facilitate product identification in

the warehouse.

Findings - From the obtained results, it is interesting to

point out also the challenges faced during the transition

and adoption of new collaborative business systems.

Value – This paper adds to the growing literature in the

supply chain automated business systems.

Keywords – traceability, business process

automation, upstream supply chain, barcode, EDI

(electronic data interchange) |

|

RESUME

La mise en œuvre de l'Echange de Données

Informatisées aux fournisseurs

pour la traçabilité

en amont de la chaîne d'approvisionnement

Contexte -

Visibilité et traçabilité sont essentielles pour

construire une gestion de la chaîne d'approvisionnement

efficace en amont. Comme le volume d’achats augmente de

plus en plus en entreprise, l'automatisation des

processus a été considérée comme un moyen de fournir des

informations précises et traçables ainsi qu’une

coordination plus efficace, fournissant ainsi divers

avantages concurrentiels à long terme.

But - Dans cet article, la question de la traçabilité

sera adressée en mettant l'accent sur les différents

flux d'informations qui peuvent être automatisées. Ce

document démontre également la mise en œuvre de nouveaux

systèmes d'affaires entre le département supply chain et

les fournisseurs de l'entreprise E pour améliorer la

traçabilité de la chaîne d'approvisionnement.

Méthodologie - En utilisant une combinaison de trois

approches de transition technologique, EDI (échange de

données informatisées) a été mis en place avec les

fournisseurs de l'entreprise E: 1) Supplier Web Portal

pour faciliter la traçabilité du processus d'achat, et

2) les étiquettes de codes à barres pour faciliter

l'identification des produits dans le magasin.

Constatations - D'après les résultats obtenus, il est

intéressant de souligner aussi les difficultés

rencontrées au cours de la transition et l'adoption de

nouveaux systèmes d’affaires collaborés.

Valeur - Ce document s’ajoute au développement croissant

de la littérature sur les systèmes d'affaires

automatisés de la chaîne d'approvisionnement.

Mots-clés - traçabilité, automatisation du

processus d'affaires, chaîne d'approvisionnement en

amont, code à barres, EDI (échange de données

informatisées)

ABSTRAK

Pelaksanaan Electronic

Data Interchange oleh pemasok sebagai solusi

untuk meningkatkan trasabilitas rantai pasokan hulu

Latar Belakang - Visibilitas dan trasabilitas adalah

unsur penting untuk membangun sebuah manajemen rantai

pasokan hulu yang efektif. Seiring dengan meningkatnya

volume belanja suplai perusahaan, otomatisasi proses

dipercayai sebagai alat untuk memberikan informasi yang

akurat dan bisa dilacak, serta koordinasi yang lebih

efisien, sehingga berkontribusi memberikan berbagai

keuntungan kompetitif jangka panjang.

Tujuan - Dalam makalah ini, isu trasabilitas akan

ditangani dengan berfokus pada arus-arus informasi yang

dapat diotomatisasi. Makalah ini juga mendemonstrasikan

penerapan sistem bisnis baru antara departemen rantai

pasokan dan para pemasok Enterprise E dalam rangka

meningkatkan trasabilitas.

Metodologi - Dengan menggunakan kombinasi tiga

pendekatan perubahan teknologi, EDI (electronic data

interchange) diperkenalkan kepada para pemasok

Enterprise E: 1) Supplier Web Portal untuk memfasilitasi

trasabilitas proses belanja suplai, dan 2) label barcode

untuk memudahkan identifikasi produk di gudang.

Temuan - Dari hasil yang diperoleh, menarik untuk

mendiskusikan juga tantangan yang dihadapi selama masa

transisi dan penerapan sistem bisnis kolaboratif yang

baru.

Nilai - Tulisan ini berkontribusi pada pertumbuhan

literatur yang berkembang mengenai sistem bisnis

otomatis rantai pasokan.

Kata Kunci - trasabilitas, otomatisasi proses bisnis,

rantai pasokan hulu, barcode, EDI (electronic data

interchange)

|

|

|

For confidential reason, the identity of the company in this

Master Thesis is not revealed. It is referred to as “Enterprise

E”.

“Center C” is the alias name of one of the company’s

technology centers that has welcomed the student during her

internship.

Acknowledgment

This Mémoire d’Intelligence Méthodologique

(MIM) represents not only my work during the internship; it is

the final milestone of my two years of studies at UTC

(University of Technology of Compiegne) and specifically within

the Master of Quality program. My experience at UTC has been no

less than wonderful. I have been given trust, confidence, and

opportunity to pursue higher by my teachers regardless the

language and cultural challenges I had to deal with, undertaking

my first academic experience in France. This MIM is the result

of first experiences I have obtained at UTC and Enterprise E

working with remarkable individuals whom I would like to

acknowledge.

First of all, I would like to thank the Ministry of Education of

Indonesia, and Ministry of Foreign Affairs of France, for all

the funding they were able to provide to me in order to make my

pursuit of master’s program possible.

I would like to thank:

Prof. Dr. Ir. Irwan Katili, DEA, lecturer of University of

Indonesia, UTC alumni, for his support during the preparation of

my departure to France, for being my first and favorite French

teacher, for his belief in my potentials that motivates me to

succeed.

Dr. Ing. Gilbert Farges (HDR), director of Master of Quality at

UTC. He has been highly supportive and accommodating since the

days I began my first year of Master.

Dr. Jean-Pierre Caliste, co-director of Master in Quality and

director of Master NQCE at UTC, also my internship advisor.

Thanks to him I had the opportunity to rethink and make a

greater sense of my assignments in Enterprise E to be a

meaningful intellectual journey.

Dr. Jean Escande, director of Master of Quality, Safety, and

Environment (QSE) UTC, for his insightful lectures throughout my

two years of master program, and for attending my MIM defence as

a jury.

Celine Gambert, Supplier Leader, who is my internship tutor at

Enterprise E’s center C. Celine has been such a role model for

me, whose personality and work ethic I admire. Since the first

day arriving at Enterprise E’s center C, I always learned

something new every day from her, ranging from the technical

skills to soft skills. She encouraged me to be brave and to

better position myself while starting dialogue with different

suppliers. I always feel enriched after discussing with her.

Working with her is a privilege for me and I wish I could stay

longer in the company to learn more from outstanding

professionals of her kind.

Lionel Fah and Philippe Bansept, Supply Chain Managers of

Enterprise E, whose leadership and support have helped this

project towards success.

I would like to address a general thank you to my colleagues and

managers who have answered my questions, coached me and

collaborated with me to make the projects come true, and to my

fellow interns who have inspired me too.

Finally, I would like to thank my family, especially my parents,

for the continuous support upon their three daughters, to pursue

higher studies, to be accomplished professionals, and to make

this world a better place.

Table of Contents Table of Figures

table of contents

This MIM is a description and analysis of my five months

internship carried out as a requirement to validate the competence

obtained throughout coursework of the Master in Quality

Management, UTC.

The motivation of continuing my higher studies in the domain of

Quality Management came from one idea, inspired with the success

story of Toyota. In today’s economy, I believe that the toughest

competition is no longer business versus business, but rather

quality versus quality. Those who are the most effective and the

most efficient in their business practices are those who tops the

competition. That is why the philosophy of continuous improvement

across functional boundaries should be adopted as a culture in the

company who wants to grow sustainably. Driven by curiosity and

challenge, my planned role is to become a quality improvement

agent in the environment in which I will work at.

Having a background in Industrial Engineering and interested to

the Service Systems and Supply Chain, I decided to develop myself

by interning in a Supply Chain Department. Another criteria to

choose to intern at Enterprise E is that this company enables an

international and cross-cultural exposure, thanks to the

opportunity of working with internal collaborators across the

continents and with external global suppliers. My goal in this

first experience working in an international context was to gain

fundamental competences to begin my future career in Quality

and/or Supply Chain.

The company’s activity

sector in brief

Enterprise E is the world leader in its field, with expertise in

technology and research of the upstream large energy industries.

Enterprise E was known to contribute disruptive innovation in the

energy industry during the era when it was created, it then

continued to expand its operations and acquisitions over the

years, and remains the worldwide leader as of today. With revenue

EUR 33 billion on 2013, Enterprise E is serving areas worldwide.

As the price of energy goes up, budgets are swelling, so energy

companies will find ways to keep investing a reasonable unit cost

while scaling up productions. They will turn to companies like

Enterprise E which is set for a gusher of profits.

For confidential reason, figures on activity sector will not be

discussed in this MIM.

For this internship, I was welcomed in one of Enterprise E’s

technology centers in Europe, call it center C. I was assigned to

implement new business systems within the supply chain department,

and suppliers with who center C is expected to have transactions

of EUR 72 million by the 2014 Year End.

Entreprise E has numerous relations with suppliers located

throughout the world. Figure 1 illustrates the global distribution

map of the center C’s top 115 suppliers.

Figure 1.

Global supplier distribution map of Enterprise E’s technology

center C [1]

table

of contents

The supply chain department

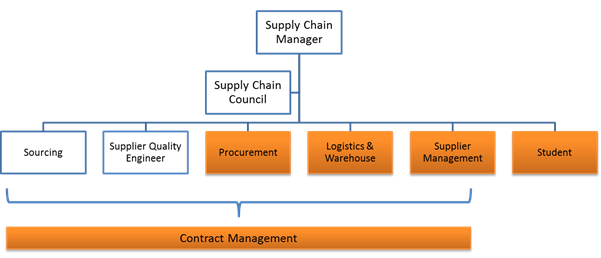

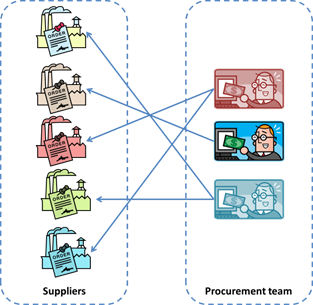

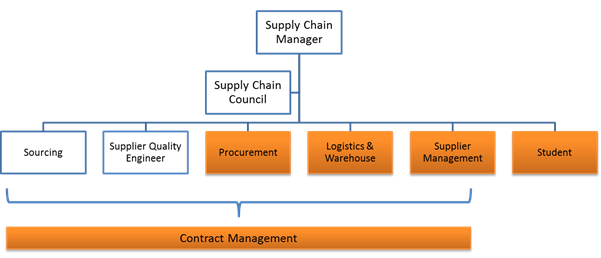

Figure 2. The supply

chain organizational structure [1]

In this internship, I worked mainly with four supply chain

collaborators as highlighted above:

- Procurement Team

- Warehouse Team

- Supplier Managers

- Contract (Legal) Department

Learning goals

At the beginning of the internship I formulated several learning

goals, which I wanted to achieve:

- to understand the role of Supply Chain in

manufacturing and service industries;

- to observe what is like to work in a

professional environment;

- to see if this kind of work is what I really

want for my future career;

- to validate my skills and knowledge obtained

during my studies;

- to see what skills and knowledge I need to

develop to work in a professional environment;

- to learn how to organize several parallel

projects given a limited time

- to learn how to improve processes using robust

methodologies;

- to get on-the-job experience in an environment

unknown for me;

- to learn how to adapt working in another

country, with co-workers from different cultures;

- to enhance my professional communication

skills;

- to build a network.

This MIM contains problems discussed in literature studies, not to

mention my activities that have contributed to achieve a number of

my stated goals. In the following chapter a general description of

the company’s upstream Supply Chain topology, and how traceability

is vital, is given. Then I will illustrate how technology can

allow company to have a better traceability. Later a reflection on

my methodology, the results and the learning goals achieved during

the internship are described. Finally I will conclude on the

internship experience according to my learning goals.

Glossary

- Barcode

a machine-readable code in the form of numbers and a pattern of

parallel lines of varying widths, printed on a commodity and used

especially for stock control.

- Barcode Label

Material with a adhesive backing that has a printed bar code on

the face.

- Business Intelligence

Business intelligence (BI) is a set of theories, methodologies,

architectures, and technologies that transform raw data into

meaningful and useful information for business purposes. BI can

handle enormous amounts of unstructured data to help identify,

develop and otherwise create new strategic business opportunities.

- EDI

Electronic Data Interchange (EDI) is the computer-to-computer

exchange of business documents in a standard electronic format

between business partners.

- ERP

ERP is an industry acronym for Enterprise Resource Planning.

Broadly speaking, ERP refers to automation and integration of a

company's core business to help them focus on effectiveness &

simplified success.

- Internal Supply Chain

Internal supply chain refers to the chain of activities within a

company that concludes with providing a product to the customer.

- Invoice

A list of goods sent or services provided, with a statement of the

sum due for these; a bill.

- Order Acknowledgment

An Order Acknowledgment is a confirmation to buyer that supplier

has received and processed buyer’s order.

- Procurement Department

The Procurement Department is the office responsible for the

acquisition of supplies, services, and construction in support of

the Authority's business.

- Purchase Order

A purchase order (PO) is a commercial document and first official

offer issued by a buyer to a seller, indicating types, quantities,

and agreed prices for products or services.

table

of contents

Chapter 1. The importance of

traceability in upstream supply chain

1.1. Context

It has become the key objectives for a company’s upstream supply

chain management to provide the right product, at the right time,

the right quality, quantity, and the right price, to support the

internal operations of the company[2]. Upstream activities can

oftentimes hold great importance for companies, because many

traits valued by end users might be influenced or directly defined

by partners maintaining upstream activities. Likewise, many

strategic initiatives taken by various companies like e.g. quality

improvement, timely delivery and innovation are often directly

linked to the performance of upstream activities, and must be

handled proactively by companies reliant on the performance of

others.

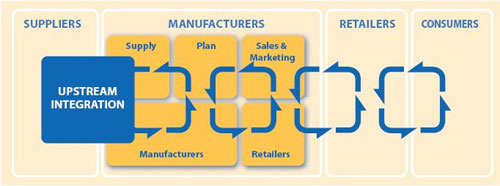

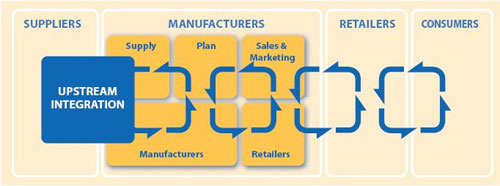

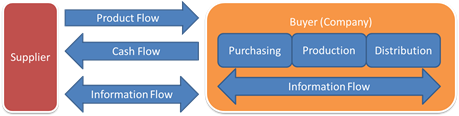

Figure 3.

Upstream supply chain deals directly with suppliers[3]

For this pivotal role, supply chain department is therefore

responsible to coordinate well with suppliers. Companies might

actively engage suppliers in R&D projects to secure the

capabilities of suppliers, or develop other competencies of

suppliers like e.g. speedy delivery, high quality and high

reliability. The key is to identify what is valued by the end

consumer, and thereafter secure or develop the needed competencies

required of suppliers. Likewise, companies may engage in IT

sharing with upstream partners that will potentially secure a more

streamlined reordering, capacity planning and forecasting, so that

suppliers and logistic partners are able to meet specific

requirements related to production capacity, time of deliveries

etc.[4]

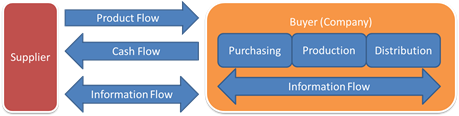

Figure 4.

Coordination between supplier and buyer[1]

(Adapted from APICS, version 2.2, 2011 Ed. Pg. 1-3, with

modifications)

Figure 4 presents a relatively straightforward, horizontal and

linear view of upstream supply chain, which is often not the case.

The flows of goods, information, knowledge, and funds across

supply chain are oftentimes uncoordinated and fragmented. In the

real process flow, there is always a space for improvements on the

interfaces between each entity.

1.2. Benefits of

traceability in upstream supply chain operations

1.2.1. Process traceability

When volume of transaction flows with suppliers gets higher,

traceability is needed to improve the communication efficiency,

and to avoid getting lost in the middle of the complex processes.

Today’s traditional supplier-buyer communication use emails, fax,

and telephone to get the business done. That is, to imagine how

many emails diffused by an X number of procurement team to a Y

number of suppliers.

This situation can be improved by providing a more practical tool

to trace and monitor this communication that can serve as a

strategic tool for managers. In order to reduce costs and improve

efficiency, many corporate giants are now demanding that their

suppliers convert their transaction operations into EDI

(electronic data interchange) systems. This subject will be

further discussed later in the next chapter.

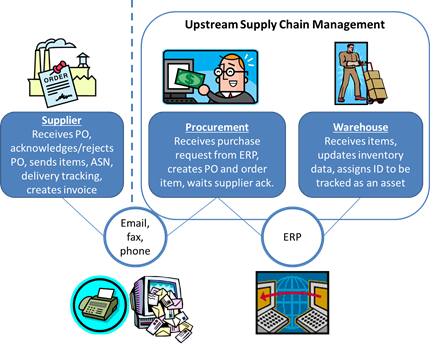

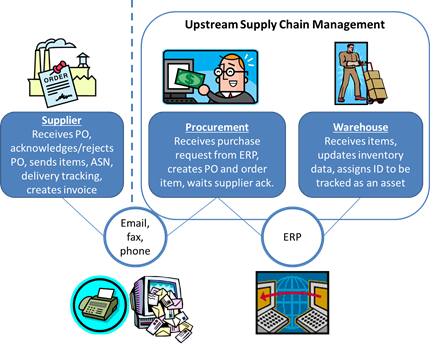

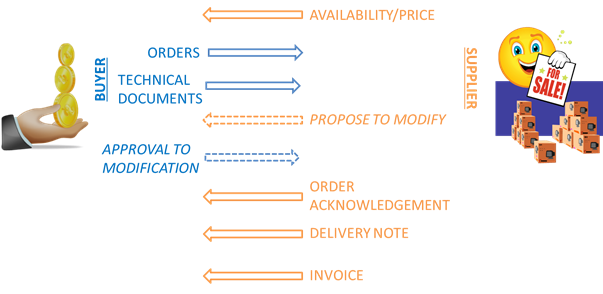

Figure 5.

Supplier-buyer communication flow during purchases[1]

Figure 6.

Upstream supply chain activity during a purchase activity[1]

1.2.1. Product

traceability

Traceability is also needed in the communication between warehouse

and procurement team, especially during reception of items. When

supplier items arrive with traceability labels (e.g. barcode),

warehouse team can scan the labels to trace and identify the

corresponding purchase orders. Based on this information scanned,

the data are then automatically updated in the company’s ERP

(enterprise resource planning) such as Oracle, SAP, MfgPro,

telling that items have been received. The procurement team can

then process the payment.

In a more global context, upstream supply chain operations can be

very critical. Given one example: Enterprise E is targeting to

improve its asset management, that means operating and maintaining

its tangible assets cost-effectively. Although this goal concerns

mostly the ready-to-use assets downstream supply chain, relevant

information associated with the asset has to be provided from the

very upstream, so in case of any repairs, information can be

traced backward.

Center C either sells parts to the customer that come directly

from the suppliers, or uses parts from the suppliers to

manufacture internally a final product, which is then sold to the

field. In a specific case of Enterprise E, when an accident caused

by field equipment happens, one can trace the root cause of the

defect. It can be caused either by bad manufacturing, or by bad

parts coming originally from suppliers upstream. In the latter

case, it is important for upstream supply chain activity to

implement traceability labels. Records of all purchased products

shall be maintained and kept, so if a problem arise, the company

can trace back to where they started.

1.3. Problem scope

This internship addressed the traceability issues in upstream

Supply Chain. Process automation has been discussed internally by

Enterprise E to become the solution to traceability issues. My

assignment is to begin implementing this solution and then

increase users’ adoption. The directly concerned parties are the

suppliers and the internal supply chain department (in this

internship mission, particularly procurement team and warehouse

team).

This internship’s focus is on the socio-technical aspect of the

process automation, and not on the system programming which is

under the responsibility of IT department and software provider.

The scope of this MIM does not, however, deeply discuss about ROI

(return of investment), and the direct impact of this project to

company’s profitability, all which have been conducted internally

by Enterprise E prior to this implementation phase.

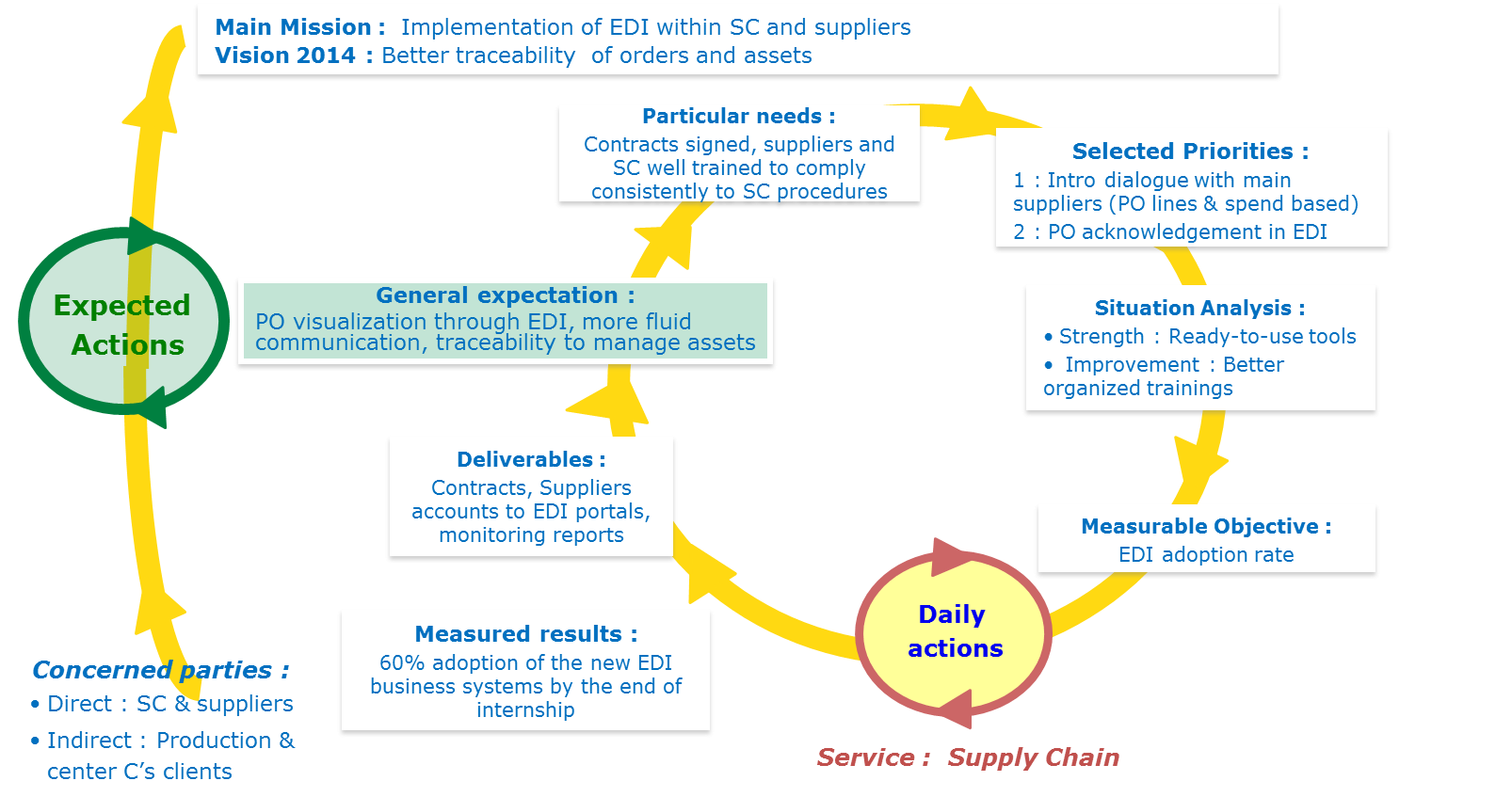

1.4. Objectives

The objective of traceability in supply chain management is to

organize all activities related to the flow o¬f products and

information process from the beginning of the supplier’s cycle to

the end-user[5]. The challenge is to manage this process in such a

way as to establish collaborative alliances with strategic

suppliers[6] and to explore alternatives in which the management

of suppliers can be used to gain a competitive advantage in the

industry[7].

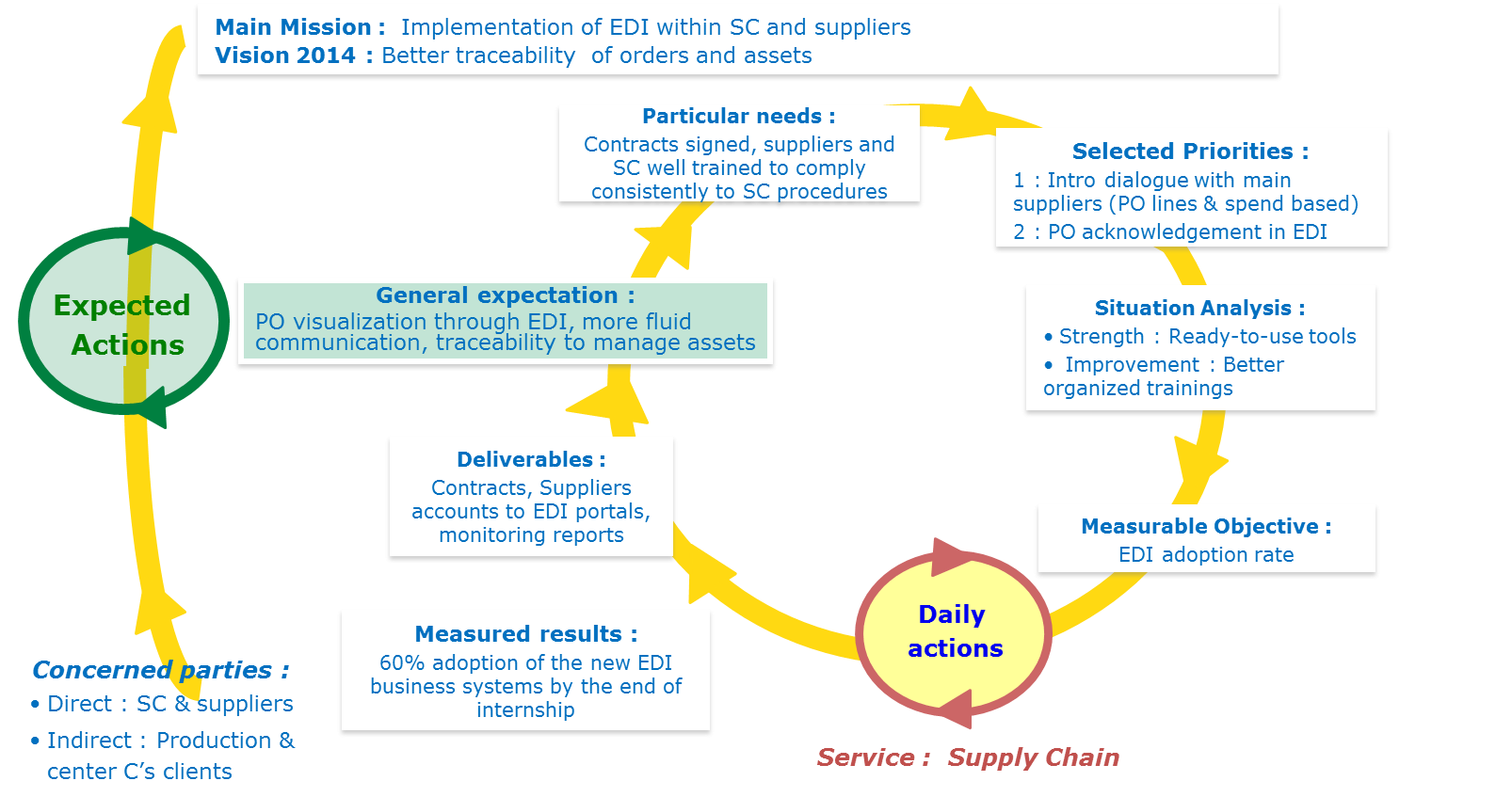

However, in this internship, the objective is broken down into

more precise action items (see Figure 7). A selection of add-on

EDI (electronic data interchange) technologies was proposed, those

are:

- Implementation of Barcode labels by

suppliers, for a traceable inventory reception in warehouse

- Implementation of Supplier Web Portal with

suppliers, for a traceable purchasing activity in procuremen

Figure 7.

Strategic planning to achieve the internship objective[1]

1.5. The principal norms and regulatory requirements

1.5.1. The ISO standard on traceability

This MIM takes a closer look to the complex set of traceability

issues within upstream Supply Chain of Enterprise E, in which the

company attempts to create value for its stakeholders in the

continuous improvement framework. The concept of traceability was

based on ISO 9001:2008 and ISO 8402, and the company aims to

maintain the compliance with this standard to further manage their

processes better.

This paper also focalizes on the concept of process as today

mirrored in the prerequisites of normative quality, as the new ISO

9001: 2008 standard encourages a process approach to quality

management. Business processes are valuable corporate assets since

they directly support corporate business strategies. Business

processes, therefore, need to be managed and optimized just as any

other business assets[8].

To explicit, two selected traceability issues are covered within

this internship:

1) Physical flow (later referred to as product

traceability), and

2) Information flow (later referred to as

process traceability)

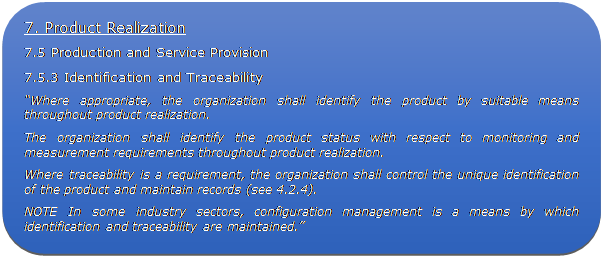

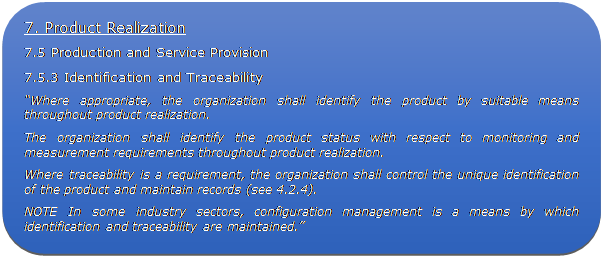

As for product traceability, let us recall the following chapter

of ISO 9001: 2008[9]:

There are three different requirements specified in this

chapter[10]:

• Product identification - means knowing the

identity of (yours or customer supplied) product from - incoming

receipt of materials; raw material storage; use in production;

work in progress; finished product storage; and delivery of

product to the customer. Product identification can be controlled

using physical and electronic methods.

• Product status - means knowing the quality

status (good or bad) of materials and product through each of the

above stages. Product status can be controlled using physical and

electronic methods.

• Unique Product Identification - is not a

mandatory requirement under ISO 9001, unless contractually

required by customers or regulatory bodies. In certain industry

sectors such as the automotive or aerospace or pharmaceutical

industry, unique product identification is mandatory for safety,

regulatory and risk management reasons. This usually involves

keeping detailed records of product manufacturer - material;

equipment; personnel; processes; production; inspection and test

details, etc., for individual products or production batches.

These records help to trouble-shoot product and process problems;

resolve customer complaints; and enables continual improvement of

product and process. In many instances, it also reduces cost, risk

and use of resources by narrowing the problem down to a specific

cause or instance. Depending on the product, the OEM may specify

the degree of unique identification and traceability required.

Examples of product identification and test status include

physical tags, bar code labels linked to computer records; MRP

systems tracking specific production runs/lots; automated

production transfer processes, etc. Performance indicators (to

measure the effectiveness of processes that control identification

and traceability) may include - reduction in identification errors

and omissions; product quality status errors and omissions; and

traceability errors and omissions.

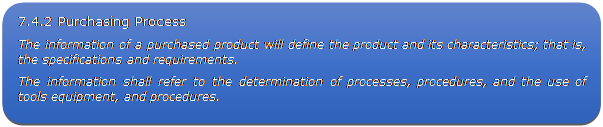

As for process traceability, there is one crucial requirement

regarding information flow, particularly in purchasing activity.

Traceability and its records must be maintained. Let us recall the

following chapter of ISO 9001:2008[9]:

ISO Standard clearly requires maintaining records, which target is

to provide objective evidence that the processes were conducted

effectively. There is a freedom to select which communication

channel to send orders, be it e-mail, printed orders, or by the

installation of an EDI (electronic data interchange). There is no

requirement to documents the method of transferring an order to

the supplier, but there is a requirement to prove it with records.

1.5.2. The legal

requirements of automated business process

The selected method of traceability and documentation discussed in

this MIM is the use of EDI (electronic data interchange) in

business transactions. In general, most EDI communications between

businesses utilize existing telecommunications facilities.

Although direct point-to-point transmission of EDI communications

between trading partners does occur, the more prevalent practice

(both domestically and internationally) is communication through

third-party networks or service providers. These providers are

able to achieve economies of scale that make their service an

attractive alternative to internal capital investment in EDI users

in network facilities, even for those who have the economic

capability to make such an investment[11].

The biggest issue in EDI implementation is that all transactions

during procurement/purchasing are paperless, because information

is recorded and modified throughout the machine (computer and web)

and people have been questioning if paperless contracts are valid

enough to be recognized[12]. To solve this problem, suppliers and

buyers usually establish a Purchase Terms & Conditions that

specifies EDI in the beginning, and a Computer Based Information

Agreement, signed prior to implementation of EDI (creation of

accounts). EDI users usually also enter into a service

agreement/legal contract with a third party provider. Pursuant to

the agreement, the provider essentially functions as an electronic

mail processing system, and may either 1) maintain electronic

“mailboxes” for trading partners into which EDI communications may

be placed, or 2) interconnect with other providers in order to

facilitate communication between their respective customers[11].

1.6. The prospective ethical and societal dimensions

This will not be described deeply in this MIM but there are two

potential things to highlight in further studies:

- Product traceability: In a Corporate Social

Responsibility context, traceability allows companies to account

for the ethical, social, and environmental impact of its products

along their supply chains.

- Process traceability: Process automation has

been seen as a competitive strategy in creating traceability, it

makes companies’ processes become lean. The main benefit of

process automation is that companies can improve the efficiency

and productivity of its service. On the other hand, any new IT

system can also be seen as a cost-cutting tool by employees that

will lead to dehumanization and reduced job opportunities. The

approach to implement the new system has to take into account this

aspect.

Consideration of the ethics of technology implementation in

business transactions has also mainly focused on areas relating to

the abuse of information collected. In this context, the main

issues include security and privacy of information about companies

and ownership of information that can be traced by fraudulent

activities. Clear contracts have to be set between the concerned

parties to guarantee the security of information exchanged in the

web portals. A risk analysis regarding to data security will be

assessed later in the next chapter.

table

of contents

Chapter 2. Implementation of automated manual data

entry in purchasing and reception

2.1. Top benefits of automating manual data entry in

purchasing and reception

EDI has helped simplify and improve commerce between trading

partners for years and its benefits continue as it

improves more business processes such as electronic

procurement, automated receiving, electronic invoicing, and

electronic payments. EDI can reduce the cost of personnel and

office space, improve data quality, speed up business cycles,

improve efficiency, and provide strategic business benefits[13].

To deeply elaborate the benefits of process automation through EDI

(electronic data interchange) briefly described in the previous

chapter, we will describe the benefits into five categories as

shown in the table below[14]:

Table 1. Five

benefit categories of EDI [14]

Reason #1: Monetary savings |

Automated

solutions for inventory and procurement deliver big

savings over manual systems — from reduced

administrative costs to shortened procurement and

fulfillment cycles. An automated bid system also

drives down the cost of supplies by allowing

procurement staff to increase the number of potential

vendors and identify preferred suppliers. In large

properties, where purchasing responsibilities are

spread over several departments or several locations,

an automated inventory and procurement solution can

maximize buying power by consolidating orders, which

typically lowers the cost per transaction and results

in deeper volume discounts. |

Reason #2: Time savings |

An

automated inventory and procurement solution saves

time by streamlining purchasing and inventory control.

Tasks that once took hours or even days can be

performed with a few clicks of a mouse. Staff no

longer wastes time matching receipts with deliveries,

figuring out overly complex invoices and keying in

redundant information. Properties also will see a

reduction in the administrative tasks involved with

vendor management, such as creating contracts and

soliciting bids. Likewise, purchasing managers will

spend less time overseeing administrative details and

more time analyzing spend patterns and negotiating

favorable terms with suppliers. |

Reason #3: Increased

accuracy |

An

automated inventory and procurement solution increases

accuracy. Because staff is no longer required to

re-enter data from paper documents, clerical errors

and ordering mistakes are reduced. Moreover, automated

solutions link usage to demand, enabling properties to

maintain up-to-the-minute inventory counts, obtain

accurate operating costs, track the cost of sales and

identify the best and worst performing cost centers. |

Reason #4: Enhanced

negotiations |

In

order to effectively negotiate with

suppliers, managers must understand what they are

purchasing, in what volumes and at what price. An

automated inventory and procurement solution can

provide this information, giving procurement

professionals greater leverage to negotiate price

breaks, volume discounts and favorable payment terms.

Armed with details about spending patterns, purchasing

staff is able to view the ‘big picture’ and make

fact-based decisions that result in cost savings and

more accurate inventory counts. |

Reason #5: Increased

compliance |

Properties

are finding it necessary to standardize procurement

processes and make sure employees at all levels are

using pre-negotiated pricing. For procurement

managers, an automated solution ensures that a single

standard for buying a certain kind of product is

enforced across the board. An automated inventory and

procurement system also helps curtail ‘maverick’

buying, or the practice of purchasing items outside of

the preferred system, through approved vendor lists,

pre-sourced catalogs and standard ordering and

approval processes. Centralized tracking allows

purchasing managers to monitor off-contract buying and

ensures compliance with established contracts.

In an

industry where margins are tight and multiple

departments often requisition items several times a

day, it makes sense to automate inventory and

procurement. An automated system not only optimizes

existing resources and prevents unnecessary costs, but

also positions the property for success, in the

short-term and the future. |

Sometimes, in order to make a decision to embark on a new EDI

program or expand their current EDI projects, companies seek

quantitative data to educate their executive teams and drive a

more holistic understanding of the EDI processes and benefits for

the greater organization[13]. They want hard facts that answer

questions such as:

• How many days earlier can orders be shipped

when EDI is used for the ordering process?

• What are the actual cost savings that

companies realize when they use EDI Advance Ship Notices (ASNs)?

• What are the actual cost savings that

companies realize when they use barcode labels or RFID tags?

• What are the top challenges that businesses

face when EDI is not used as part of the ordering process?

• How do supplier companies really benefit when

they comply with their customers’ requests to exchange business

documents via EDI?

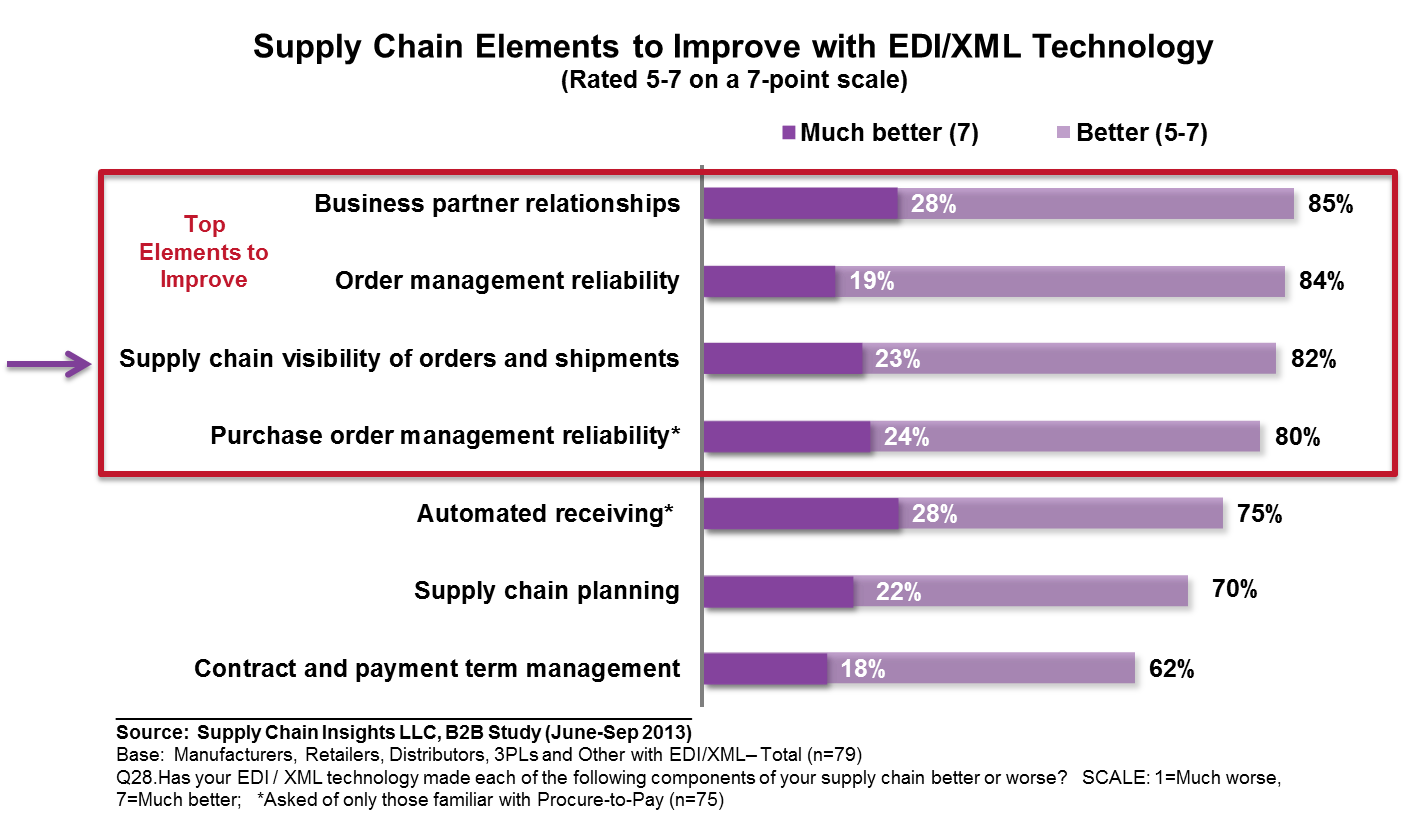

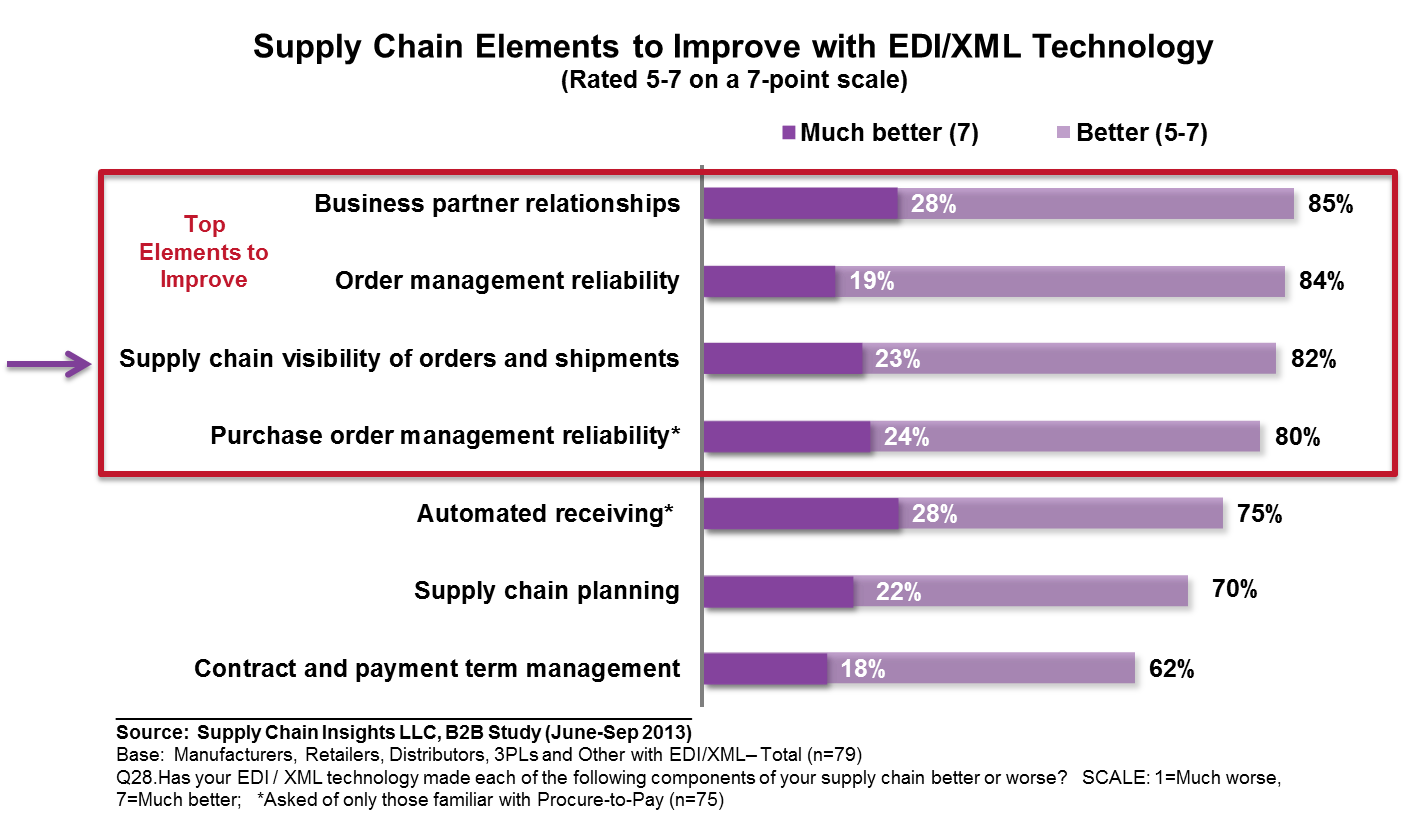

82% of respondents in Supply Chain Insights’ new study “EDI:

Workhorse of the Value Chain” indicated that one of the major

improvements resulting from their EDI programs was better or much

better visibility of orders and shipments in the supply chain[14].

Figure 8. Supply

Chain Elements to improve with EDI/XML technology[15]

It’s easy to understand why the visibility benefit was one of the

top four: 1) Business partner relationships, 2) Order management

reliability, 3) Supply chain visibility (traceability) of orders

and shipment, 4) Purchase order management reliability. In today’s

fast-paced business environment, having real-time insight into

transaction status is the key to enabling faster decision-making

and improved responsiveness to changing customer and market

demands. Businesses need to know answers to questions such as:

• “Was my order accepted?”

• “Which version of the order are you shipping

against?”

• “Will the order ship on time?”

• “What is the status of my invoice?”

EDI transactions enable that vital level of real-time visibility

and traceability into status of orders in the supply chain. For

example, using EDI, a manufacturer in Houston, Texas can send a

purchase order to its supplier in Malaysia, receive an electronic

document that the item is out-of-stock, and immediately react by

sending the purchase order to an alternative supplier in Dubai –

all in just minutes. Armed with this information businesses can

effectively manage bottlenecks, plan for delays, and proactively

manage customer expectations. In short, they can resolve issues

before they have a negative impact on business performance.

Here are just a few of the EDI documents that enable visibility

into the supply chain:

• Purchase Order Acknowledgment: Confirmation to

the buyer that the supplier will be filling the purchase order as

requested.

• Advance Ship Notice: An electronic version of

a printed packing slip that tells a buyer that goods have been

shipped, how they have been packed and the estimated arrival time.

• Invoice: Request to the buyer to pay for the

shipped goods.

In summary, EDI provides the foundational technology that, when

combined with other collaborative commerce capabilities available

today, enables dramatic strategic benefits.

table

of contents

2.2. The EDI collaborative tools

2.2.1.

Tool #1: Supplier Web Portal for purchasing activities

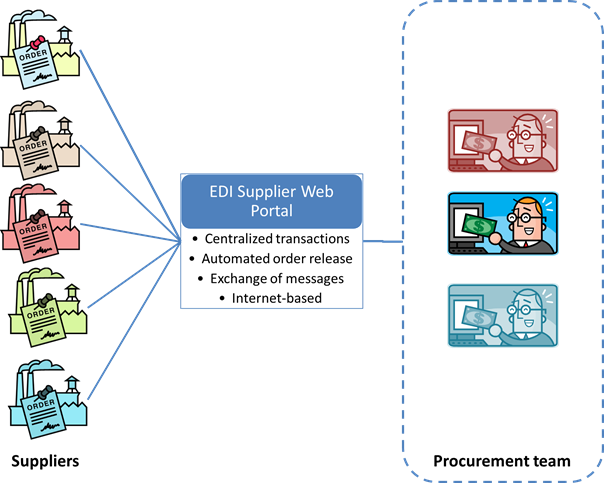

To improve the process traceability in the upstream supply chain

of Enterprise E, Supplier Web Portal was implemented. Procurement

professionals are the lifeblood of the company to guarantee stable

supply chains. It is the company’s interface who deals with

suppliers when placing orders and ensure the suppliers acknowledge

the reception of orders and abide to the schedule agreed during

order placement. To make fluid the communication in this

interface, a contribution of IT is essential. Supplier Web Portal

tool allows suppliers to receive and acknowledge orders in

real-time, right when orders are set in the company’s ERP.

Supplier Web Portal tool also allows the supply chain manager to

visualize the all transactions with suppliers on a purchase order

line-by-line basis. The tool includes also a log of the specific

transactions (order date, part technical reference and revisions,

shipment initiated, goods received, etc.)[16].

Supplier Web Portal provides full visibility and traceability of

purchasing activities, allowing supplier responsiveness to be

monitored, orders to be chased/quickly acknowledged and arrival

dates maintained. The common unified paperless database can be

used to track all open, closed, and canceled purchase orders,

along with message exchange between suppliers and buyers, so

nothing is invisible or hidden under buyer’s email inbox.

Orders, once planned, are fed to the manufacturing group, placed

to supplier, and tracked throughout the process all the way to

delivery. Just a few years ago, this chain of processes required

days of sequential telephone, fax, and computer queries. In

addition, it was fraught with errors, added time, and information

disconnects.

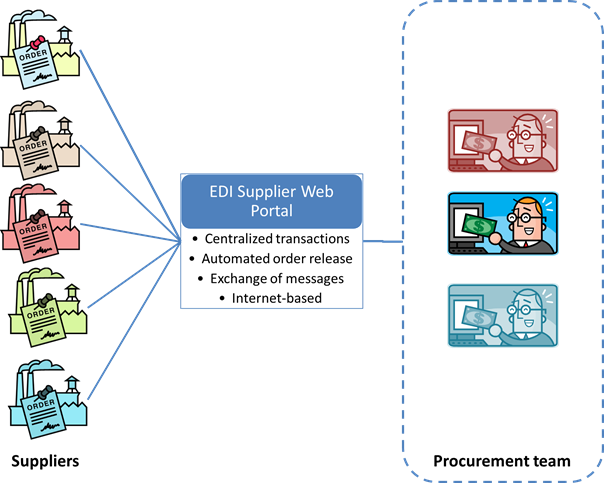

Figure 9.

Improved purchasing activity - post implementation Supplier Web

Portal[1]

table

of contents

Figure 10.

Message flow diagram in Supplier Web Portal[1]

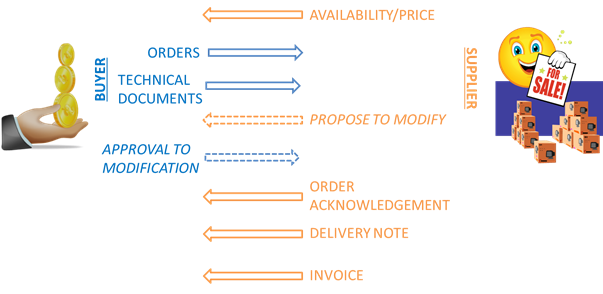

The real-time shared collaborative Supplier Web Portal tool

delivers powerful advantages to buyers and suppliers. These

results include fewer mistakes in orders, reduced lead times, and

shortened cycle times[16].

With Supplier Web Portal, not only buyers can benefit, suppliers

also can:

• Receive email alerts when there is new PO or

PO revision

• View & acknowledge orders

• Self-service Engineering Bill of Materials

& Drawings

• Alert buyer of incoming goods via Advanced

Shipment Notices

• View status of goods receipts

• Check status of invoices and payments

• Collaborate with Procurement by exchanging

messages (for example, to propose a new delivery date, quantity,

price, etc).

On top of that, there are also intangible benefits for suppliers:

• Staying competitive – supplier’s ability to

respond to customers’ needs as

efficiently as the other rivals, and

• Moving towards an exception based end-to-end

process within supplier’s supply chain, concentrating human effort

on areas that improve efficiency and customer service.

table

of contents

2.2.2. Tool #2: Barcode labels for warehouse activities

Supplier barcode labelling or automated identification has been

known to help reduce human error in logistics. Furthermore, it

helps not only the identification during reception, storage and

picking in the warehouse, but also passing along the information

all the way midstream (manufacture) and finally downstream to the

end-user. Automated identification enable the visibility and

traceability of products, regardless its supply chain

complexity[17].

The human error that occurs during warehouse reception has a

non-negligible cost. There are many calculations for the cost of a

data entry error. The elements involved in an incorrect data entry

include[18]:

• cost of recovering the item;

• labor cost of in-handling and checking the

item on its return;

• cost of picking the replacement item;

• cost of re-packing;

• cost of re-delivery;

• cash flow with reference to non-payment of

invoice;

• potential loss of sale for the product

incorrectly dispatched;

• cost of re-training staff; and

• potential stock write-off if the returned

product is outside an acceptable shelf life or has been damaged in

transit.

To give another example of the use of barcode labels during

picking, imagine a warehouse with 20 order pickers that pick 100

cases per hour (based on an eight-hour day, 253 days per annum).

An accuracy rate of 99.5 percent incurs 20.240 errors per annum.

An increase in accuracy to 99.8 percent reduces the errors to

8.906 errors. If each error costs a conservative $29, that amounts

to annual saving of $475.000. Note: this is just a general example

to illustrate the situation, as I am not in charge of evaluating

the cost aspects of this project for Enterprise E.

To improve the traceability and accuracy for warehouse activities,

Enterprise E provides a Barcode Web portal from which suppliers

can print 2D or QR barcode labels for each product ordered. This

Barcode Web portal is connected with the Enterprise E’s ERP

(enterprise resource planning) that will provide the information

as follows:

• purchase order number, purchase order line,

• part number,

• supplier name and/or reference,

• quantity of product/serial number,

• batch/lot number,

• delivery date requested,

• date of production, and

• date of expiration, if applicable.

Every Item Part and/or its package shall be labeled with a Barcode

Label before delivery to ensure traceability of the Item Part to

its original Purchase Order or Work Order. The barcode label

printed out of the Barcode Web Portal, a self-adhesive label, is

to be applied to the top left corner of each package.

The item or package label must be generated via the Barcode Web

Portal, and not from any other barcode generator, to be registered

into the Enterprise E’s Global Traceability system and assigned

the Global Traceability key which is part of the barcode syntax.

No software or software licensing fees for suppliers to access the

Barcode Web Portal. Supplier needs only to click on each order

number listed on the Barcode Web Portal that corresponds to a

product ordered, and then print a barcode label out of it, to

finally stick it to the product accordingly. Some requirements are

needed before being able to implement barcode labels: quality of

label paper, type of printer compatible to print 2D barcode, and a

person assigned to access the Web Portal.

Prior to implementation, the supplier shall submit the name and

email of the contact person(s) who should be printing barcodes to

goods before expeditions. This contact person will then be created

an account and trained to use the Barcode Web Portal. It is the

responsibility of the supplier to provide barcode labels that meet

all of the specifications of Enterprise E. The supplier shall be

responsible for verifying the accuracy of the label and ensuring

that the data is

current and correct. Enterprise E won’t drop suppliers simply

because they don’t bar code. However, over time, as bar coding

becomes more important in Enterprise E’s goods receptions and

operations, it is possible that, everything else being equal, bar

code labeling could be the determining factor in selecting one

supplier over another.

With Barcode Web Portal, not only buyer can benefit, suppliers

also can:

• Track good receipts,

• Adding value into service to customers.

table

of contents

2.3. Methodology

As important as finding the right program to automate the system,

implementation of the program itself is very important. To

determine the “best practices” for implementing new automated

business system, there are three most widely discussed ERP and/or

EDI implementation strategies that I refer to:

Table 2. EDI

implementation strategies [20]

Method |

Strength |

Weakness |

1) Big bang

Description: Implementation happens in a single

instance. All users move to the new system on a given

date. |

· Short

implementation time

· Difficulty

and pain are condensed

· Costs

are much lower than a long, drawn out implementation

· Employees

only need to be trained on the new system, not for the

changeover period

· Implementation

happens on a single date and everyone knows the date |

· Difficulties

are more pronounced, risk is high

· Details

may be overlooked in the rush to change

· Employees

have less time to learn the new system

· Full

end-to-end system testing is tough to carry our prior

to implementation

· Fall-back

scenarios are more difficult than originally perceived

· A

failure in one part of the system could affect others

· There

is a catch-up period (users are struggling with the

new system and organizational performance temporarily

declines as a result).[20] |

2) Phased rollout

Description: Changeover occurs in phases over an

extended period of time. Users move onto new system in

a series of small steps. |

· Companies

gain knowledge and experience during the initial

implementation phase that can be applied to subsequent

phases

· With

conversion occurring in parts, time is available for

adjustments

· There

is no catch-up period, employees learn as they go

· More

time for users to adapt to the new system

· Technical

staff can focus on one part of the system or a select

group of users at one time

· Project

members may develop unique implementation skills that

they can be positioned for in later rollouts |

· Not

as focused and urgent as big bang

· Involves

continuous change over an extended period of time

· Several

adjustments are needed

· Duration

of the project is much longer than big bang

· Temporary

bridges must be created between legacy system and new

system |

3) Parallel adoption

Description: Both the legacy and new ERP

system run at the same time. Users learn the new

system while working on the old. |

· The

least risky implementation process

· Users

can learn the new system while performing regular work

activities on the old system.

· User

adaptation is easier than big bang

· The

pace of the changeover is faster than phased adoption |

· Cost

perceived is the biggest trade-off

· Having

users enter data in both systems is inefficient |

I realized while one strategy may work for a majority of

companies, it may not be the best strategy for another

organization. In some cases, a phased deployment might be more

appropriate than a parallel deployment, in some other cases, it

might be the opposite. Depending on the goals, each company might

prefer a combination of strategies. There is no one-size-fits-all.

Before starting the implementation, a little telephone survey was

hosted upon other technology centers of Enterprise E in Europe, to

get the idea what might be the best alternative strategy for

Enterprise E’s center C. Without giving a regard on the size of

the technology center and the number of its suppliers, the survey

uncovered that it took them two years in average to implement the

new automated systems within the supply chain department and 80%

of all suppliers. The strategy chosen by the centers having

already implemented the new automated systems was a combination of

phased rollout and parallel adoption, customized to each new user.

The consideration behind it is to avoid disturbing production and

other business activities happening during new business systems

implementation.

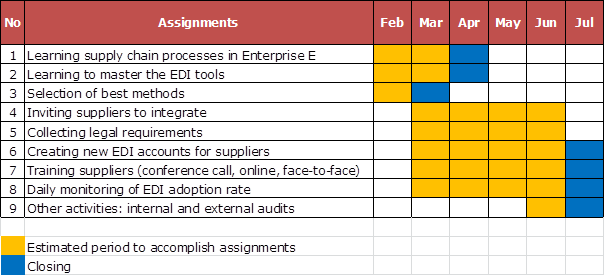

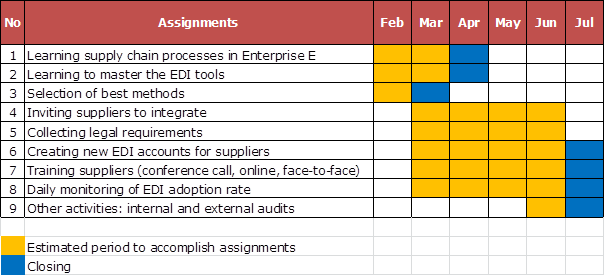

Based on this valuable feedback, considering the very limited time

of my internship (five months), and the ambitious 2014 year-end

target, a fast-paced work has to be done. A timeline was then

created (see Appendix) in order to help plan the actions. A

combination of phased rollout and parallel adoption was then

selected, to avoid disrupting the purchasing activity with shock

effect of Big bang.

table

of contents

2.4. Risk

assessment to EDI implementation

Before implementing the new business systems, I analyzed the risks

existing associated to the EDI business systems implementation.

Based on the risk assessment, I concluded that there are two types

of risks:

1) Technical Risks, including in-depth knowledge of EDI, B2B, and

Internet

Security (this needs to be further assessed by technical experts),

and

2) Business Risks, including process improvement, process

documentation, project leadership, and culture analysis and

management.

Table 3. Risk

assessment to EDI implementation [1]

Risk |

Actions |

Who follows up? |

Personnel security

factors |

Background checks

• User IDs/passwords

• Trace of

individual accounts and time stamping |

· EDI IT Help

· Project champion |

Contractual

security factors |

Customer

contracts/requirements

•

Trading partner agreements (Purchase Terms &

Conditions)

•

Confidentiality agreements (Computer Based

Information Agreement)

•

Employee contracts and code of conduct

•

Contractor contracts and code of conduct

• Third

party—service bureau—contracts |

· Supplier leader

· Project champion

· Legal department

· Third party EDI

provider |

Data/Transaction

security factors |

• Encryption -

switch this on to ensure that the in-flight data

cannot be read

• Digital

certificates to be able to access technical

documents associated to each purchase order |

· Project champion |

System security

factors |

•

Passwords/PINs

•

Administrative levels of access |

· Project champion |

Network security

factors |

• Web connectivity

(automatic sign out when idle)

• Security protocols |

· Third party EDI

provider |

Business

Resumption/Disaster Recovery factors |

• Backup

copies

• Backup

rotation/transport schedule

•

Security of offsite storage facility |

· Third party EDI

provider

· EDI IT Help |

User resistance

during roll-out |

• Upper management

leadership

• Strategic

communication

• Intensive training |

· Project champion |

table

of contents

2.5. Resources and

team

Resources and team – As a student, I am assigned to dedicate to

the implementation of the new systems (“champion”), to ensure the

project is kept on track and moving in the right direction. The

responsibility of a project “champion” was:

• Assist with technology center’s roll-out plan

• Convince suppliers to abide and invest in the

new business systems

• Check legal requirements (Purchase Terms and

Conditions, Computer Based Information Agreement)

• User account creation for internal Supply

Chain team and suppliers

• Password resets for users

• Supplier and Buyer Training

• Fielding “Level 1” questions:

o I can’t log in.

o I can’t print a PO.

o I can’t retrieve drawings or BOMs.

o I can’t print a barcode.

o I want to change the information on my

barcode.

o I have missing data.

o How don’t get an alert when I receive a new

order….

Below is the flowchart of how I organize my daily actions as a

project “champion”.

Figure 11. Actions

plan for EDI implementation in Enterprise E[1]

To play well this role of project “champion”, one has to be

influential, be able to win over resistance, and promote the

project. One has to have the knowledge to understand the daily

issues and processes affected. This “champion”, has to have the

backing at the management level, to make the team concentrate not

only on the daily workload but also the requirements of the

project.

The technical ability of the new systems is inevitable for a

project “champion”. Therefore, at the beginning of the internship,

a month was taken to learn and understand the existing business

processes and the new tools (see Appendix). It was a real

challenge because there was no trainer initially in center C for

these new tools, and I had to figure out the functionalities by

myself with user guidelines, to be able to answer the

particularity of each questions from new users. I would however,

from time to time, address all questions that I cannot answer

myself to the project global managers in the headquarter level.

However, the “champion” needs to know how to use the new systems.

For the order visibility tool for example, based on the nature of

the system, all internal Procurement Specialists are obliged to be

involved with the system. Being in contact with suppliers, they

have to adopt a positive attitude towards the change because this

attitude will amplify further down to external users.

Other functions concerned would be Supplier Managers, as they are

the ones to whom the technical questions from external users

(suppliers) might be addressed, once my internship ends and that I

am no longer in charge of the system.

table

of contents

2.6.

User population mapping (selection of prioritized suppliers)

The first step is to identify the users to be affected by the new

automated system. Vision of target user population has to be clear

to provide insights on the strategy.

Starting point situation analysis was placed in the beginning of

the traceability projects. Among 115 suppliers, 19 were already on

Supplier Web Portal system, only 5 are using, of which only 2 are

using it nearly systematically.

The study-dependent variables were “Supplier Web Portal tool use

versus non-use” and “Barcode labels use versus non-use”. No

assessment was made in advance to determine if suppliers had

similar portals with other customers and if they had adequate

infrastructure to implement it, but rather invitations were sent

to prioritized suppliers. They were asked to integrate with center

C’s Supplier Web Portal and Barcode labeling systems, and once

they agree, ensure they fulfill the legal requirements before

granted access, going live and receive necessary trainings and

materials.

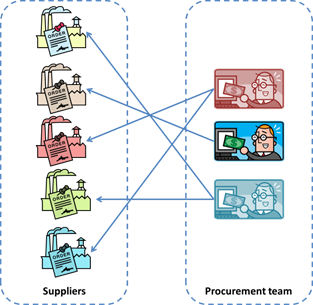

Due to the massive number of suppliers in center C, priorities

were ranked descending out of suppliers representing 80% of center

C’s purchase order lines and 80% of annual center C’s spend. This

high percentage, if succeeds, could not only save energy and

become a steep ladder to make the most impact and help reach year

end user rate target, but also because there is already an

established trust based on dependency between these suppliers and

center C that will catalysts adaptability to change.

table

of contents

2.7.

Supplier Performance Control

An assessment of suppliers performance is made every month to

measure and control the supplier’s adoption to the new business

systems. There are three control tools used:

1) Business Intelligence – to visualize the

number of Purchase Order lines received with barcode labels, from

which we could judge the percentage of supplier’s adoption rate to

the barcoding requirements.

2) Open Orders Report – to calculate how many

open (current) orders have been received through Supplier Web

Portal in percentage of total purchase orders.

Improvement actions are taken if results are not in line with

targeted progress. These are such as discussing with unconvinced

suppliers to engage, in a more personalized, case-by-case

approach, and by conducting more trainings with suppliers.

table

of contents

Chapter

3. Managing the technological change

3.1. Results of new systems implementation

3.1.1.

Results of Supplier Web Portal implementation

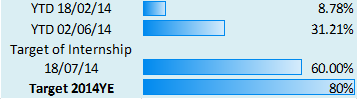

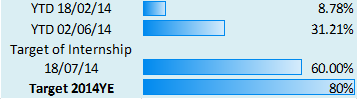

Figure 12.

Purchase orders acknowledged through Supplier Web Portal[1]

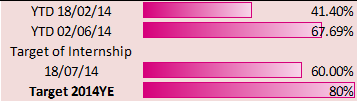

Figure 13.

Suppliers with Supplier Web Portal capability (in % spend)[1]

The result obtained from the implementation of Supplier Web

Portal is shown above. After the first three and a half months of

implementation, as of June 2nd 2014, 31.21% of all open purchase

order lines were acknowledged (Figure 11).

As of the same date, 67.69% of suppliers have submitted legal

requirements and thus have the login access to the portal (Figure

12). A more intensive training is needed for these suppliers in

order to achieve higher usage/adoption rate.

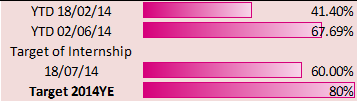

3.1.2. Results of supplier barcode label implementation

The result obtained from the implementation of supplier barcode

labels is shown below. As of June 2nd 2014, there has been

evolution of supplier barcode label adoption rate. 85.1% of

purchase order lines were labeled with barcode by suppliers on

that manufacturing month (June 2014), while it started with 73.1%

in the beginning of the internship (February 2014).

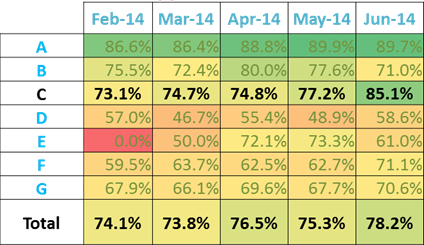

Table 4.

Percentage of purchase order lines labeled by suppliers per

month[1]

Table 4 also shows that center C has reached above the targeted

80% of year-end supplier barcode labeling. By June 2014, it was

the best performing center in terms of product traceability

(supplier barcoding), second to center A in Japan who tops the

list with 89.7%.

Following cut-over to live operation with the initially targeted

trading partners, the next stages in due course should include

extending the barcode implementation to a wider group of

suppliers.

table

of contents

3.2. Developing best practices to drive adoption

During implementation, one thing to highlight is that it is not

simply about the use of the new system, but the reasons behind why

such new systems are undertaken have to be elaborated to meet the

needs of the business. Here is where an interpersonal skill of a

project “champion” is needed to persuade others to adopt the

change. The project “champion” should be able to communicate to

raise awareness, to give context sensitive help,

telephone/face-to-face support, and ongoing hints and tips.

As a project champion, I created a list of best practices to

successfully implement EDI (electronic data interchange) with

suppliers, gaining end-user adoption:

1) Define your desired results, set and share

clear, measurable goals

2) Give reward/say thank you for collaborating

3) Assemble and maintain the competent project

team

4) Stakeholder involvement – Communication plan

5) Make user training a priority – Training

strategy

6) Ensuring getting the right data into the

system

7) Participation and leadership of upper

management

8) Coordinate with ITHelp and EDI third party

provider

9) Continuous improvement

table

of contents

3.3. Lessons learned

The massive list of Enterprise E’s suppliers from all over the

world offers valuable insights about how technology in

communication can be harnessed for a complex network.

During the dialogue and implementation of the two technologies

among suppliers, several things were discovered. Among those are:

-

Capability to provide goods with certain

specifications will get the supplier selected, but an alignment

with the buyer’s business systems will get good prospective long

term relationship. The demonstrated capability of a supplier to

meet product specifications at a competitive cost is enough to

create a market linkage, but the sustainability of the

buyer-supplier relationship requires more than just delivering a

product at a given price. From the buyer’s perspective, if a

procurement decision is only based on cost, then as new supply

options emerge, there will frequently be a cheaper supplier

producing equal or better quality. To maintain its

competitiveness, the supplier needs a full understanding of the

buyer’s business model, a comprehensive set of competencies to

serve that business model, and favorable conditions in the

business environment.

-

Buyers often do not understand the production

capacities and business environment of a particular supplier and

so impose new business systems that are not aligned with local

conditions. Similarly, suppliers rarely understand the end-market

needs and trends for their products and so are not fully aware of

the buyer’s business systems. One example, there are at least

three suppliers who refused to adopt the supplier barcode labels

because they outsource the production and it is located in a

different country of where they are. Therefore, these suppliers do

not rely on giving the authority to the outsourced parties to

print Enterprise E’s barcode labels. In this situation, it is

difficult to engage suppliers. The temporarily used palliative

action for this case is to print the barcode once it arrives at

center C. Some solutions/alternatives remain to be discussed with

suppliers for long-term plan.

table

of contents

3.4.

Recommendations

One important thing I find that was not included during my

internship mission was to do a Regression Test of the existing

processes when introducing change. For example, consider if Supply

Chain department is successfully placing orders through Supplier

Web Portal, and one now wants to start accepting electronic orders

and invoices, as a project champion, I should not only test that

the orders and invoices received work but I should also test that

the standard ordering process is in no way negatively impacted by

the new changes. Regression testing is designed to test whether

unexpected problems have been introduced to what may appear to be

unrelated areas[21].

It is believed that the two collaborative portals have long term

benefits to a business that are clearly defined, and as such, much

easier to justify than many information technology (IT) projects.

To prove that the investment worth made in enhancing product and

process traceability, however, a profit analysis should be made.

This was done in the earlier phase prior to implementation by

Enterprise E. However, a post-implementation verification is

needed to see if ROI is aligned with the estimated one. The

profits and cost saved divided by the costs of professional

services (i.e. project management, training and technical support)

needed to implement new automated business systems, custom

development costs, and the hidden costs such as travel costs,

travel time and project management time. Hardware and

infrastructure costs are to count as well.

To ensure the continuity of project especially after goal is

achieved, it is essential to create a project team. Firstly,

Enterprise E will need to identify a project champion in the

company, and then build a support team of well-trained supply

chain personnel. This internal team should definitely include the

IT department to ensure that the two portals can integrate well

with the company’s ERP. Enterprise E will need to ensure that the

supplier is capable to provide multi-source to multi-destination

integration from back-office systems, secure data infrastructure

and a dynamic supply chain community. In the contrary case,

Enterprise E will have to find a back-up plan, it could be

subsidizing the already existing suppliers to enable them to adapt

with the technology requirements, when the benefit is greater.

The last essential point is, after all, beyond costs spent to

adaptive integration of IT into operational business, there is

greater visibility that leads to better management and measurement

of the effectiveness and productivity of the whole supply chain

system. This one vision has to be acknowledged by every internal

and external collaborators to create a climate of change. So

instead of suppliers and supply chain professionals wasting a lot

of energy in fighting each other, to resist change, they instead

use this energy to work with each other on this win-win concept to

deliver results in a more efficient and effective way. This needs

the right vision about how operations can be better, how everyone

can excel in their work with IT fusion, the right vision of what

technology innovation can truly do to the organization’s quantum

leap.

table

of contents

Other Activities

Although the main and most important missions to be taken care of

were to implement order visibility tool and barcode labels, on the

course of the internship I also got involved in other activities

related to my study:

1) Internal Audit

2) External Audit

To have a first practical experience in audit, of which the theory

was taught throughout the audit course at UTC, I offered to be

involved in an internal and an external audit. To ensure I have

uniformed audit training with the other employees, I had the

privilege to be coached by the Quality Champion of Enterprise E’s

center C. I was then trusted to lead an internal audit, to verify

the compliance of Center C’s engineers, purchasers, warehouse

team, and accountants for an internal procedure. I was also one of

the five engineers to audit the activity of a local supplier. The

results of the audit are excluded from this MIM.

Aside from that, I also had the chance to travel and visit other

suppliers’ workshops, as an observer during Supplier Quality

Reviews. This has given me a more specific idea on how

supplier-buyer relationship works, and how supplier performance

and quality reviews are essential upstream activities that

contributes to the success of the company.

table

of contents

Conclusion

On the whole, this internship was an enriching, intellectually

stimulating experience. I have gained new knowledge, skills and

met many professionals of 20 nationalities, mostly engineers, who

are highly qualified in their fields yet humble and ready to

dedicate at least 50 working hours per week. My next mission will

be to keep learning to answer these questions.

I got insight into professional environment. I learned the

different facets of working within a large company, in one of its

technology centers, the existing needs and challenges to

accomplish its projects. I learned how to lead projects of an

intercultural, interdisciplinary, intergenerational, and

international team.

I observed that internal and external communication, as in many

organizations, is an important factor for the progress of

projects. I also learned how to deal with people resistance to

change, and how to convince others to collaborate in projects that

first might not seem to have immediate benefit to them. Because of

the nature of the projects, I am also now more confident in

initiating communication with trading partners using multiple

languages.

The internship was also good to find out what my strengths and

weaknesses are. This helped me to define what skills and knowledge

I have to improve in the coming time.

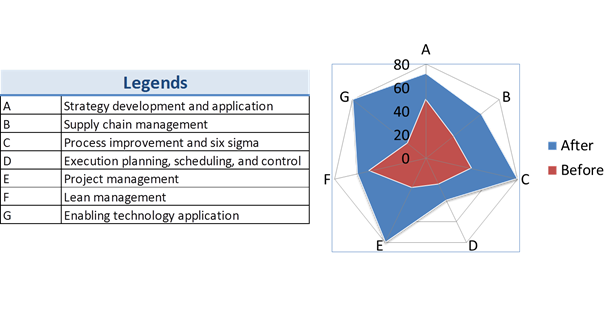

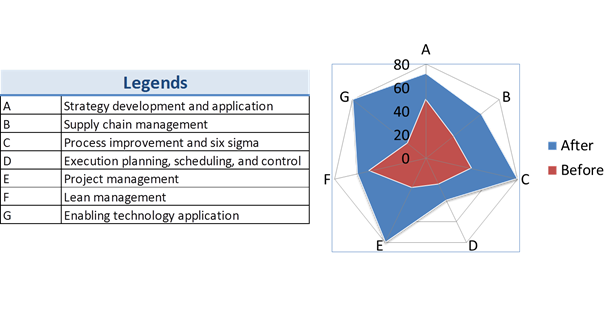

Throughout the internship, I have gained two kinds of competencies

(see Appendix):

1) Foundational Competencies

2) Profession-related competencies

The experience also brought continuous improvement to internalize

my mindset and working culture, like the figure below.

Figure 14.

Developing the continuous improvement attitude [1]

As for today, I am more determined and convinced to pursue career

in Quality and/or Supply Chain, not because I feel I am already

good, but rather because the more I observe new aspects these two

domains, the more curious I become about the subject, the more I

believe there are still a lot to learn. This becomes a challenge I

would like to answer.

Last but not least, the internship was a great opportunity to

expand my professional network which may prove value in the near

future.

My competence, knowledge, and aptitude is now strengthened and

consolidated, and therefore I am eagerly looking forward to soon

become an independent, ethical and responsible professional in the

domain of Quality and Supply Chain.

***

table

of contents

References

[1] Nurhayati K., Implementation of EDI Technologies by

Suppliers to enhance Traceability in Supply Chain, Université de

Technologie de Compiègne, Master Management de la Qualité, Mémoire

d’Intelligence Méthodologique du stage professionnel de fin

d’études, www.utc.fr/master-qualite, « Travaux » «

Qualité-Management », June 2014.

[2] Sabri E.H., Gupta A.P., Beitler M.A., Purchase Order

Management Best Practices: Process, Technology, and Change.

J. Ross Publishing, p.128

[3] GS1 Global Language of Business, Upstream Integration

Background, http://www.gs1.org/upstream/overview, as viewed on

June 16th 2014

[4] Business Mate, Supply Chain Management: Upstream Activities

http://www.businessmate.org/Article.php?ArtikelId=231, as viewed

on June 6th 2014.

[5] Handfield, R. B and Nichols, E. L. Introduction to Supply

Chain Management, Prentice Hall Inc. 1999.

[6] Dyer, J. H., Cho, D. S., & Chu, W. 1998. Strategic

supplier segmentation: The next best practice in supply chain

management. California Management Review, 40, 57-77

[7] Porter M.E., Millar V.E.. 1985. How Information Gives You

Competitive Advantage. Harvard Business Review, vol. 63, no.4, p.

149-160

[8] Lee J.K.. 2012. Business Enterprise, Process, and Technology

Management: Models and Applications. IGI Global Snippet, Business

& Economics.

[9] ISO 9001:2008(en). Quality management systems — Requirements.

www.iso.org, 2008.

[10] ISO 9001 Training – Understanding ISO 9001:2008, Requirements

for Quality Management Systems.

www.askartsolutions.com/iso9001training, as viewed on June 6th

2014.

[11] Ritter J. B. Private Trade Data Networks: A Commercial

Tapestry in Progress, A.B.A. Business Law Section Paper, Aug. 7,

1990

[12] Drake D.J., Ciucci J.A., Milbrandt B. Electronic Data

Interchange in Procurement. Maryland, Logistics Management

Institute, April 1990

[13] Cohen R. EDI Hard Facts #5: How EDI Improves Supply Chain

Visibility. Available on www.gxsblogs.com as viewed on June 4th

2014

[14] Top Benefits of Automating Inventory and Procurement.

Agilysys Solutions, 2012. Available on

http://news.agilysys.com/hospitality/top-benefits-of-automating-inventory-and-procurement/

as viewed on June 4th 2014

[15] Cecere L., 2013. EDI: Workhorse of the Value Chain A Closer

Look at B2B Connectivity Benchmarks in the Extended Supply Chain.

Supply Chain Insights, p. 9. As viewed on May 29th 2014,

available on

http://supplychaininsights.com/wp-content/uploads/2014/02/EDI-Workhorse_of_the_Value_Chain-10_FEB_2014.pdf